MSME

MSME sector needs most policy attention of all stakeholders: Niti Aayog VC

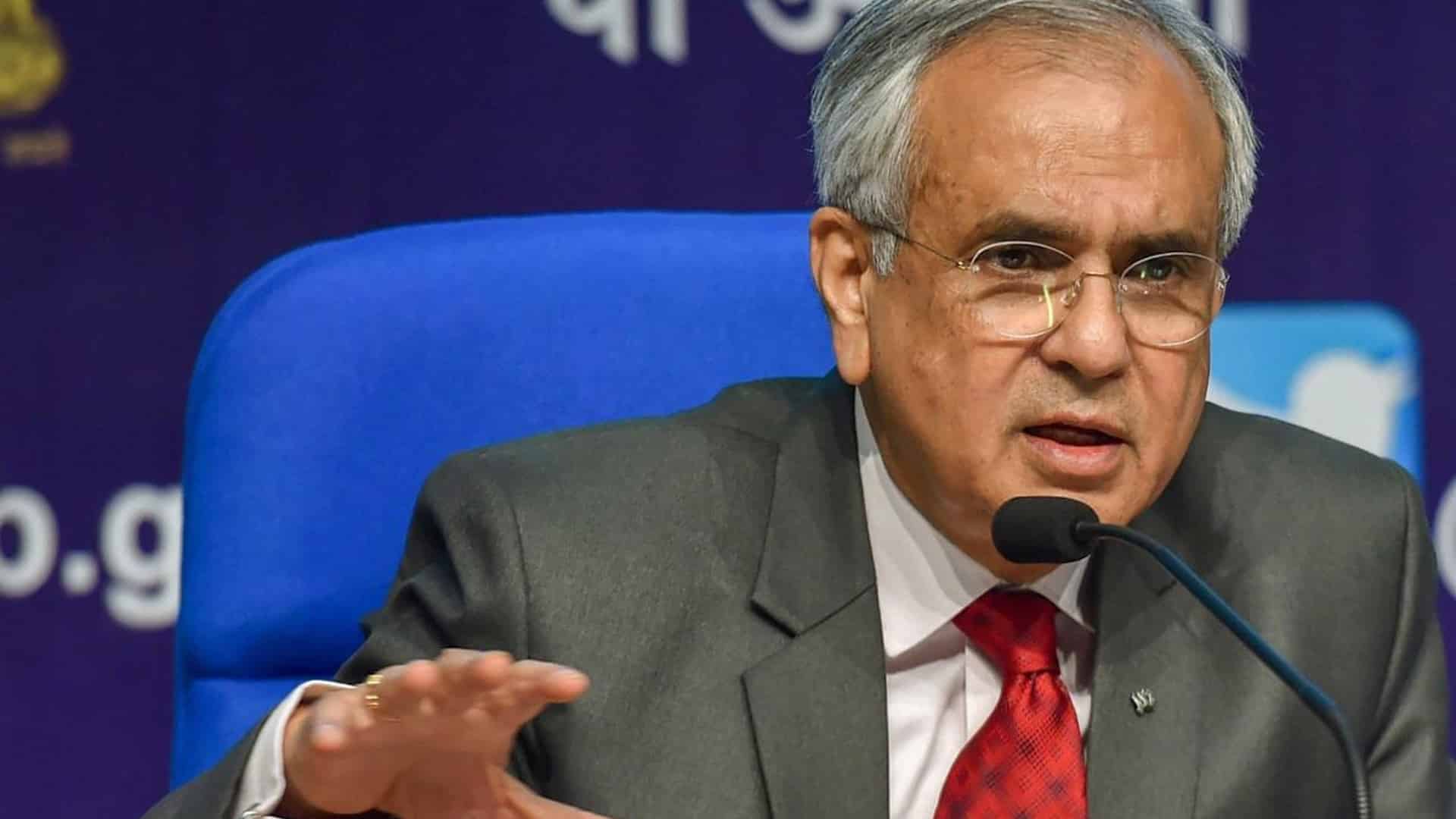

The MSME sector needs most policy attention, and the government will continue to do whatever is required to promote the sector, Niti Aayog Vice-Chairman Rajiv Kumar said on Friday. Speaking at a virtual event organised by the Institute for Studies in Industrial Development (ISID), Kumar said the government and the Reserve Bank of India (RBI) have announced several measures to help the micro, small and medium enterprise (MSME) sector.

“The MSME sector needs most policy attention of all stakeholders… A lot has been written about the MSME sector but some of the challenges of the sector remained unmet till recently,” he said. Kumar said MSME earnings have been hit by 50 per cent, and one out of three such firms suffered revenue and profit decline during the pandemic. “We will continue to do whatever is required to promote the MSME sector.”

Also read: CESL inks pact with HPCL for EV charging points in metro cities across India

Listing out several measures announced by the government to help the MSME sector, he said that under the Emergency Credit Line Guarantee Scheme (ECLGS), Rs 2.73 lakh crore has been sanctioned. “Risk capital requirements for MSMEs have been taken care of,” he said. Kumar said that with the change in definition of MSMEs and labour reforms announced by the government, India’s small and medium firms can now become part of global supply chains.

He said 49.8 per cent of India’s exports come from the MSME sector. Even today, 99 per cent of the total 63 million MSMEs are ‘micro’ and just 1 per cent entities are in the range of ‘small’ and ‘medium’ enterprises, Kumar added. He also stressed the need for increasing expenditure on research and development (R&D), which is currently below one per cent of gross domestic product.

Pingback: Microsoft likely to invest in Oyo ahead of its IPO