EA Sports

EA to Go Private in Record $55 Billion Deal With PIF, Silver Lake and Affinity Partners

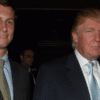

Donald Trump’s son-in-law Jared Kushner, CEO of Affinity Partners, described EA as an “extraordinary company” that he has admired since childhood

Electronic Arts (NASDAQ: EA), one of the world’s leading interactive entertainment companies, has unveiled a definitive agreement to be acquired by a consortium of investors led by Saudi Arabia’s Public Investment Fund (PIF), Silver Lake and Affinity Partners, led by Donald Trump’s son-in-law, Jared Kushner. Valued at approximately $55 billion, the all-cash transaction marks the largest sponsor take-private investment in history, signalling a major shift in the gaming and esports landscape.

Under the terms of the agreement, the consortium will acquire 100% of EA’s outstanding shares. Stockholders will receive $210 per share in cash, a 25% premium over the company’s unaffected share price of $168.32 on September 25, 2025. PIF will roll over its existing 9.9% stake in EA into the new ownership structure.

Why This Matters for EA and Its Players

EA said the deal will accelerate its strategic vision to “advance the future of entertainment,” leveraging the new owners’ capital, global networks and deep sector expertise. With partners spanning gaming, sports, and digital media, EA expects to blend physical and digital fan experiences, unlocking new growth opportunities worldwide.

Saudi Arabia’s PIF Acquires Pokémon Go Developer Niantic’s Gaming Division for $3.5 Billion

Andrew Wilson, EA’s Chairman and CEO, called the agreement a “powerful recognition” of the company’s creative teams and their ability to deliver “extraordinary experiences for hundreds of millions of fans.” He added, “Together with our partners, we will create transformative experiences to inspire generations to come. I am more energized than ever about the future we are building.”

Donald Trump’s son-in-law, Jared Kushner, CEO of Affinity Partners

Strategic Fit for the Investors

Turqi Alnowaiser, Deputy Governor and Head of International Investments at PIF, highlighted the fund’s commitment to the gaming and esports sectors, saying the partnership will “fuel innovation within the industry on a global scale.”

Egon Durban, Co-CEO of Silver Lake, praised Wilson’s leadership, noting that EA has doubled revenue and nearly tripled EBITDA under his tenure. Jared Kushner, CEO of Affinity Partners, described EA as an “extraordinary company” that he has admired since childhood.

Deal Structure and Timeline

The transaction, approved unanimously by EA’s Board of Directors, is expected to close in Q1 FY27, subject to regulatory approvals and shareholder consent. Following completion, EA will remain headquartered in Redwood City, California, with Andrew Wilson continuing as CEO. The company’s common stock will be delisted from public markets.

Funding for the acquisition will include approximately $36 billion in equity from the consortium and $20 billion in debt financing solely committed by JPMorgan Chase.