Economy

Economists want Budget to support economic recovery amid third wave of COVID-19 infections

With the Budget due on February 1, economists want the government to support the country’s economic recovery amid the third wave of COVID-19 infections. They believe higher allocations for capital spending and tax incentives will encourage private investment.

HFCL set to use CommAgility’s 5G new radio software for indoor small cells

Experts say a reduction in the goods and services tax (GST) for a limited duration to trigger demand, income-enhancing or support measures, front-loading of transfers to states and sustained credit to small and medium enterprises (SMEs).

Many economists believe a higher public capital expenditure would be most welcomed. They expect private investment to be stagnant, except for a few sectors and states that remain cautious due to fiscal constraints. DK Joshi, a chief economist at Crisil, said given that fiscal position has been reasonably sound during April-November, the forthcoming budget will need to continue pressing the pedal hard on infrastructure-focused capital expenditure as the private corporate investment cycle is yet to turn decisively.

Nomura expects higher caseloads of COVID-19, but a shorter duration for the third wave, meaning that economic damage is contained within Q1 2022 and limited to delaying a recovery in contact-intensive services. Its outlook report highlighted that rising inflation expectations, tight labor market and supply constraints are increasingly making the central bank hawkish. “On domestic growth, most segments, particularly consumption and services, are well below the pre-pandemic growth trend,” it said. “Profitability is improving, leading to a sharp rise in the earnings to GDP ratio. The market will increasingly focus on earnings growth beyond FY24F, which will be increasingly dependent on the broader economic growth, in our view.”

Nomura expects India’s growth cycle to begin decelerating from the second half of 2022, beyond the growth gyrations caused by the third wave. “We expect reflecting weaker consumption due to scarring effects and high inflation, weaker export growth and subdued private capex due to low capacity utilization.”

Also Read: Third wave of COVID infections could slow India’s economic growth in near term

Madan Sabnavis, the chief economist at Bank of Baroda, sought an easing of the fiscal deficit target. He said to earmark additional 0.5% over and above what is fixed as fiscal deficit. “So if the government plans 6.5%, it can add 0.5% more for capex. A push of 0.5% would mean an increase of Rs 1.3 lakh crore in the capex. This will be a big push and can be funded through borrowing.”

Furthermore, ICRA called for expedited capital spending and frontloading transfers to states to the extent possible to help them to prioritize capital spending as well.

Pingback: Sanfe has stepped into the beauty category with the name Sanfe Beauty.

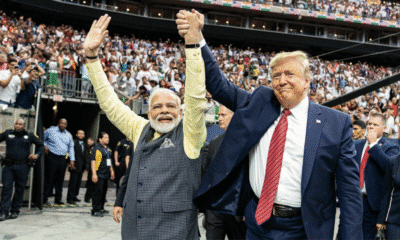

Pingback: India will transform into world’s technological and economic powerhouse.