News

The Untold Story of How Jeffrey Epstein Got Rich, According to a New Investigation

For decades, Jeffrey Epstein’s wealth baffled Wall Street, law enforcement, and the public. He presented himself as a brilliant financier managing billions for elite clients, yet left behind few paper trails and no clear explanation for how he made his money. A sweeping New York Times investigation now reveals how Epstein, a college dropout with no formal finance credentials, used scams, strategic relationships, and ruthless manipulation to climb to the top of American high society.

A Chance Encounter That Changed Everything

Jeffrey Epstein’s rise began in the mid-1970s when he was a math teacher at Manhattan’s elite Dalton School. Through a student’s parent, he was introduced to Ace Greenberg, a senior executive at Bear Stearns. Greenberg, known for hiring unconventional talent, saw potential in the young Epstein despite his lack of Wall Street experience.

At just 23, Jeffrey Epstein landed a job at Bear Stearns, earning a modest salary but gaining something far more valuable: access. The firm’s executives vouched for him, opening doors to financiers, corporate leaders, and ultra-wealthy individuals who would later become central to his fortune.

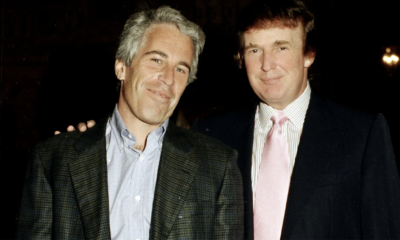

Trump Claims Epstein ‘Stole’ Virginia Giuffre from Mar-a-Lago Spa: Controversy Reignites

Building Wealth Through Deception and Influence

According to the investigation, Epstein did not become rich through traditional investing success. Instead, he leveraged prestige and proximity to power to present himself as an exclusive financial fixer. Former associates told reporters that Epstein exaggerated his expertise, promised outsized returns, and positioned himself as someone who could navigate the opaque world of elite wealth.

One key tactic was cultivating trust with billionaires and heirs, then exploiting those relationships. Epstein secured control over assets, trusts, and advisory roles that paid handsomely while remaining largely hidden from public scrutiny. In some cases, he allegedly misled clients about fees, investment strategies, and how their money was being used.

The Power of Association

Jeffrey Epstein’s credibility snowballed as he aligned himself with influential figures and institutions. His ties to Leslie Wexner, founder of L Brands, were particularly crucial, dramatically boosting Epstein’s standing in financial and academic circles. He also donated to major universities and served on prestigious boards, using these affiliations to signal legitimacy.

The Times investigation describes this as a calculated strategy: Epstein repeatedly cited powerful connections to win over new targets, creating a self-reinforcing cycle of access and wealth.

Despite managing enormous sums, Epstein left behind few conventional financial records. His wealth flowed through offshore entities, private trusts, and shell organizations, making it difficult for regulators to track. Banks and institutions that worked with him often relied on reputation rather than verification—a systemic failure that allowed his empire to grow unchecked.

Why It Still Matters

Understanding how Jeffrey Epstein got rich is critical to understanding how he evaded accountability for so long. The investigation paints a picture not just of one man’s deception, but of elite systems that prioritize connections over scrutiny. As renewed attention focuses on transparency, accountability, and justice for survivors, Epstein’s financial story stands as a cautionary tale of what happens when power goes unquestioned.