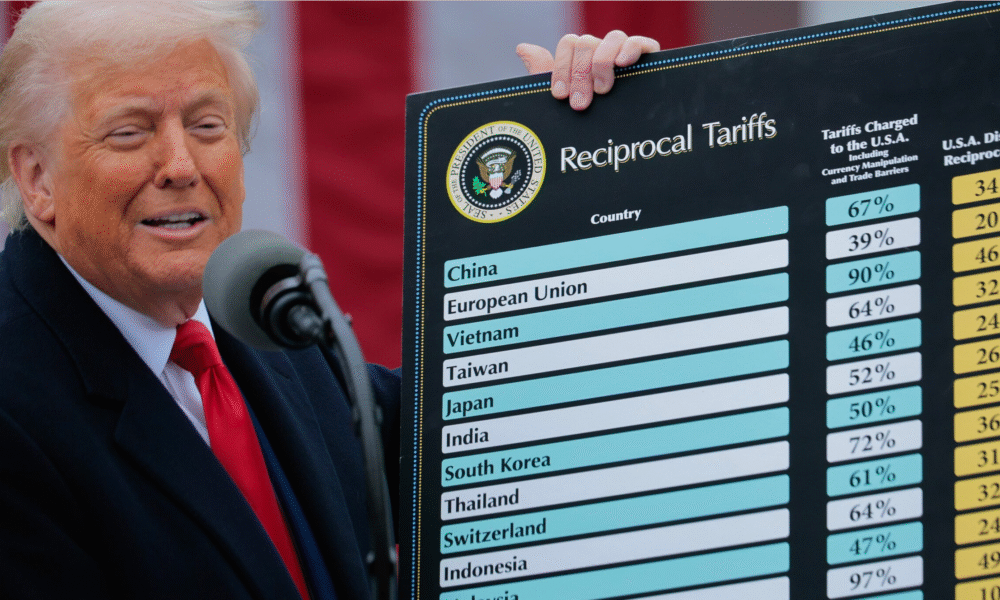

Trump Presidency

Tariff Refunds Could Trigger a $90 Billion Economic Shock — and a Legal Nightmare

A high-stakes Supreme Court showdown could soon reshape the U.S. trade landscape. After years of tension over Trump-era tariffs, a wave of potential refunds worth up to $90 billion may be on the horizon — but no one knows exactly how it would work.

During Wednesday’s arguments, Supreme Court justices from both conservative and liberal blocs expressed deep skepticism toward the Trump administration’s efforts to keep the tariffs in place. That raised expectations among small and medium-sized businesses, who’ve long challenged the levies as unlawful.

But as Justice Amy Coney Barrett pointedly asked: “If you win, tell me how the reimbursement process would work. Would it be a complete mess?”

Neal Katyal, the former solicitor general representing several importers, admitted it would be “very complicated.” And with tens of billions of dollars collected since the tariffs began, “mess” may be an understatement.

Who Gets the Money — and When?

The U.S. Customs and Border Protection (CBP) has collected nearly $90 billion from the disputed tariffs as of September, with the total still rising. But if the Court rules against the administration, the logistics of refunding those funds could take years.

According to trade attorney Thomas Beline, talking to CNN, importers might need to file protests or request liquidation extensions to preserve their refund rights. “It’s not automatic,” he explained. “You’d need to look closely at your import entries and file before they settle.”

The precedent for such refunds exists: a 1998 Supreme Court case resulted in $730 million in tariff reimbursements — a fraction of what’s at stake today. Even then, it took two years to distribute payments.

Banks and Brokers Smell Opportunity

Sensing a windfall, investment firms like Oppenheimer and Jefferies have reportedly approached importers with offers to buy their potential refund stakes for as little as 20–30% of face value.

Their pitch? Immediate cash now, rather than years of uncertainty.

But experts warn that these deals can heavily favor the buyers. Kyle Peacock, a tariff consultant, says importers under financial pressure have accepted “extremely low offers” — as little as 5–7% of potential refunds.

“There’s a real scare mentality,” Peacock said. “Some businesses are told they’ll never see a dime unless they sell.”

Refunds Could Ripple Through the Economy

If the Supreme Court sides against the Trump administration, analysts say it could spark a flood of refund claims — and possibly inject billions back into the economy. Yet for importers, the path is anything but clear.

Lawyers warn of a bureaucratic bottleneck at Customs and Border Protection, with potential delays stretching into years. Former Justice Department counsel Ashley Akers said the agency might adopt a “streamlined or automated process,” but even that could take months to implement.

And while refunds could include statutory interest, the waiting game will test the patience — and liquidity — of thousands of U.S. businesses.