Banking

Kuvera launches Jini, a chat feature to help GenZs set financial goals

Financial planning startup Kuvera has launched a new feature to assist GenZ investors in visualizing their financial goals.

Whether planning for short term financial goals such as a vacation or long-term financial goals such as retirement, visualization of financial goals is the first step towards a better financial future. Crafting a customized plan and saving accordingly helps cushion investors from market volatility and over time makes investing a habit.

Young or first-time investors may not be aware of the benefits of goal planning or may not want to work through complicated spreadsheets. Importantly, many first-time investors feel the amount they are investing is too small to spend time on planning and building their investment roadmap.

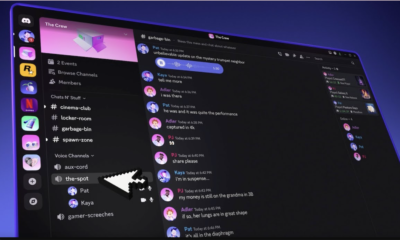

To help bridge this need, Kuvera has re-launched its goal planning feature in a new avatar – Jini, targeted at young investors. “Goal planning is the hallmark of a smart investor, and an average investor on Kuvera tracks more than two goals. We wanted to make goal-planning easy, intuitive and an absolute delight for our users. Jini, our chat-based feature, talks in a language that young investors can relate to,” said Gaurav Rastogi, co-founder and chief executive officer of Kuvera.

Jini is a unique chat-based feature that helps users plan and invest for their goals. Users on the Kuvera app can choose from a list of pre-defined goals, or even create their own. On adding a goal, Jini will ask about the timeline for the goal and the amount to be saved. Jini then crafts an action plan that could enable investors to achieve their goals within the time horizon.

“Our algorithms are designed to take out the complexity of this exercise and helps answer the key question of how much to save. With Jini, you can get up and running in minutes,” said Neelabh Sanyal, co-founder and chief operating officer.

Some of the common goals that youngsters plan for on the platform are owning a home, creating a retirement corpus, going on international vacations, or planning a dream destination wedding.

Founded by Rastogi and Sanyal in 2016, Kuvera is India’s first free platform for investing in direct mutual funds, fixed deposits, stocks and more. The online financial planning platform offers commission-free direct plan investing. Its team consisting of ex-money managers and experts help investors choose from a range of investment options such as mutual funds, fixed deposits, Indian and US stocks. So far Kuvera has more than 1.6 million investors and Rs40,000 crores worth of assets under administration.