Business

India Inc’s foreign investment rises over two times to $2.51 bn in Apr’21

India Inc’s foreign investment in the first month of this current fiscal jumped by more than two-times year-on-year to USD 2.51 billion, data from the Reserve Bank showed on Monday. Indian investors had committed USD 1.21 billion worth of outward foreign direct investment (OFDI) in April 2020. Of the total commitment of USD 2.51 billion in April this year by the Indian company owners, USD 1.75 billion was in the form of loan, USD 421.42 million as equity capital and USD 333.11 million was chipped in through issuance of guarantee, showed the RBI data on OFDI for the month of April 2021.

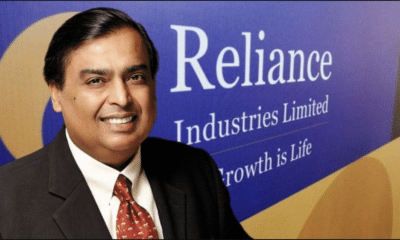

In March 2021, Indian firms made investment of over 1.99 billion in their overseas ventures. Among the major investors, Tata Steel invested USD 1 billion in its wholly owned subsidiary in Singapore, Interglobe Enterprises Pvt Ltd invested USD 145.61 million in a joint venture based in the UK and Reliance Industrial Investments & Holdings Ltd committed USD 78.52 million in a fully owned unit in the UK.

Also read: Cyclone Tauktae makes landfall in Gujarat, most severe storm to hit the region in two decades

Reliance Industries alongside Reliance Brands invested a sum of USD 91.56 million in various wholly owned subsidiaries and joint ventures based in the UK, Singapore, the UAE and the USA. Varroc Engineering put in USD 65.5 million in a wholly owned unit in the Netherlands and Motherson Sumi Systems invested USD 41.70 million in a fully owned firm in the UAE, showed the data. *The RBI said the data is provisional and is subject to change based on the online reporting by the authorised dealer (AD) banks.

Pingback: Amid devastating second wave, WHO reminds SII of its vaccine commitment for other nations