Education

An attempt to re-align Chartered Accountancy curriculum with new business realities

It has been 13 years since the Chartered Accountancy curriculum underwent a major overhaul.

“People talk of the Big 4 accounting firms. Sadly, there is no Indian firm there. By 2022, let us have a Big 8, where 4 firms are Indian,” Modi said while addressing the CAs on the Foundation Day of the ICAI (Institute of Chartered Accountants in India). It’s been 13 years since the Chartered Accountancy curriculum underwent a major overhaul.

As against a membership of 1,700 in 1949, today ICAI has 2,70,000 members. Increasing responsibilities are being entrusted by the Government and the society at large on the members of the profession and their specialized knowledge and skills are being utilized in various fields of activities

Hence stakeholder expectations were high when PM Modi released the revised scheme of education and training for students on CA Foundation Day on 1st July. ICAI has announced that the new scheme is now in sync with the major changes in the global business scenario.

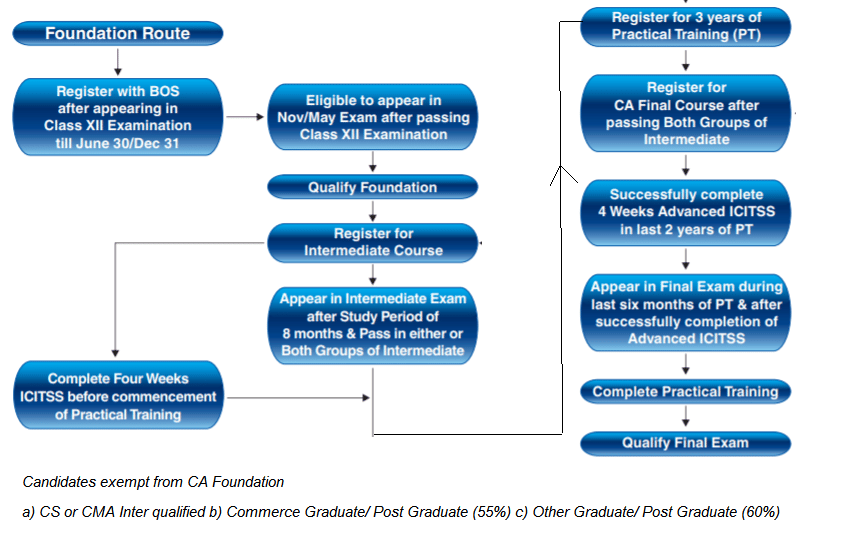

Level 1 – CPT rechristened as CA Foundation

As compared to the 200 marks objective type CPT exam, the entry process is now more stringent with a 400 marks Foundation exam, out of which 200 mark questions will be subjective and the rest objective. Passing percentage: Aggregate- 50% and Subject-wise- 40% at one sitting. Subjects are Principles and Practices of Accounting, Business Law & Business Correspondence and Reporting, Business Mathematics and Logical Reasoning & Statistics and Business Economics & Business and Commercial Knowledge.

This will ensure that quality of students who enter the system is much better.

These segment of aspirants would be exempt from CA Foundation

- Intermediate Pass students of the Institute of Cost Accountants of India and Institute of Company Secretaries of India

- Commerce Graduate/ Post Graduate (55%) Other Graduate/ Post Graduate (60%)

Level 2 – CA IPCC rechristened as CA Intermediate

There are now 8 papers as compared to 7 earlier

Enterprise Information Systems & Strategic Management is the new avatar for the erstwhile Information Technology &Strategic Management. There has been a significant quantum of syllabus re-alignment.

Let’s consider Paper 8, Financial Management, which was earlier clubbed with Costing is now a full-fledged 100 marks paper. & Economics for Finance. It now has a 40% weightage for Economics for Finance with topics like Government Interventions to Correct Market Failure etc.

Level 3 – CA Final

For enabling students to acquire specialization in a particular field, one elective paper has been introduced in the curriculum of Final Course. The students can choose a paper out of Risk Management, Financial Services & Capital Markets, International Taxation, Economic Laws, Global Financial Reporting Standards and Multidisciplinary Case Study

This is indeed a welcome move. Consider Paper 6B – Financial Services and Capital Markets. As CA students aspire to enter roles in financial services, concepts like Private Equity, Investment Banking, Fed Policy and Infrastructure Investment Trusts (Invits) will equip them with the requisite skillsets to take on the MBAs who are the default choice for these exotic fields.

There have been major change in scope/depth of coverage the existing subjects also.

Let’s consider Law. Now rechristened as Corporate Law and Economic Laws, it now introduces topics like Bankruptcy & Insolvency Code 2016, Arbitration & Conciliation Act 1996 and Foreign Contribution Regulation Act 2010. Section 123 to Section 148 of the Companies Act i.e. Dividends, Accounts and Audit have moved from Final to Intermediate.

In case of Indirect Taxes, GST now holds a 75% weightage. Concepts like Foreign Trade Policy to the extent relevant to the indirect tax laws have also been introduced.

Practical training

The 3 year articleship is what makes the CA course unique. It would be continued in the existing form

Now there would be a 4 week long Integrated Course on Information Technology and Soft Skills (ICITSS). (2 weeks for soft skills and 2 weeks for Advance IT). Students undergoing Practical training shall be required to do AICITSS during the last 2 years of Practical training but to complete the same before appearing in the Final Examination.

Summing up the chartered accountancy curriculum

Recently, the Prime Minister of the country exhorts the Chartered Accountants as the Rishi Munis of the country, the one who look after the economic health of society and whose signature is more powerful than his own. Thus, the new syllabus, especially the stricter entrance process at Foundation Level would go a long way in ensuring that this profession lives up to stakeholder expectations.

*As part of the transition, ICAI would provide a specific number of attempts to complete the CA exams under the current scheme. The last CA Final exams under the existing syllabus would be conducted in November 2020.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of the publication

Pingback: CA Course New Syllabus-An attempt to re-align Chartered Accountancy curriculum with the new business realities.