Technology

More countries want to manufacture own semi-conductors as it’s a matter of national security: Moody’s

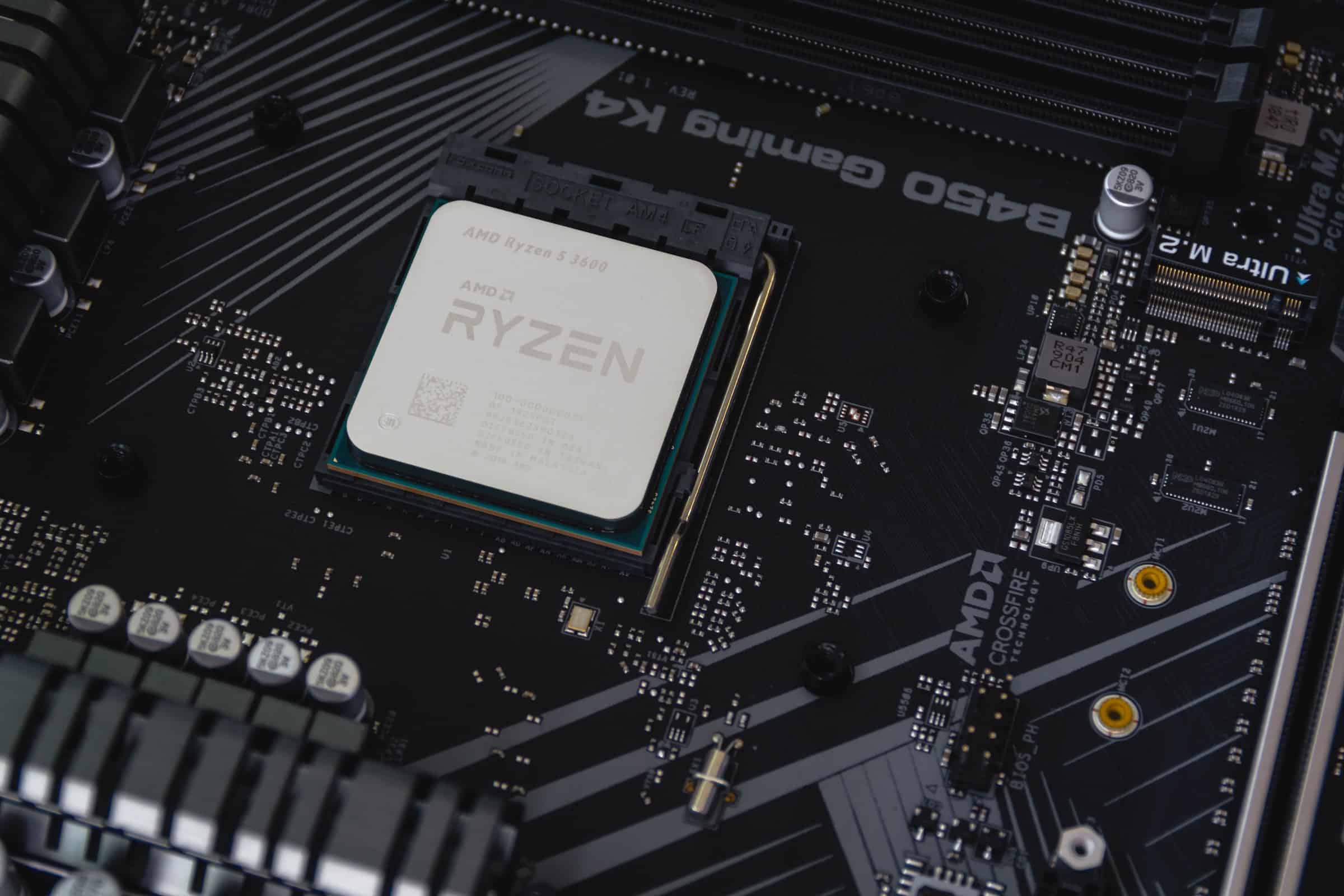

Memory chips are crucial for making a wide range of products, and as such more countries want to produce their own semi-conductors. And another reason for this push is that it’s a matter of national security.

Timothy Uy, an associate director at Moody’s Analytics, told CNBC that the main problem is that new supply is hard to come by and the surge in demand is not going to be abetting anytime soon. “On both the supply and demand sides, I think companies are adjusting. Governments are also getting in on the action because they view this as, in some sense, kind of a matter of national security.”

Memory chips can be found in smartphones, refrigerators, gaming consoles like PlayStation 5, washing machines, cars and even alarm clocks. Uy explained that manufacturing semi-conductor chips is an intricate, capital-intensive process that involves weeks of productions. He said it takes even longer to distribute them. “New supply cannot be created instantly, and sometimes, it may take years for new supply to come online as factories need to be built and fitted with the proper technology.”

It has to be noted that this is one of the main reasons as the capital-intensive nature of semi-conductors also concentrates manufacturing into the hands of a few companies, and the barriers of entry for new companies rise with new generations of chips. Moody’s analyst said the production process of each generation of semi-conductor chips is different.

“Newer chips have bigger margins that give the major manufacturers more incentives to invest in their production instead of diverting resources to increase capacity for older generation chips,” Uy said. “That’s partly why the auto industry is struggling. Cars require thousands of predominantly older-generation chips compared to smartphones and other gadgets that need a handful of newer ones.”

Also Read: Oppo set to awe with next gen under screen camera technology for smartphones

The analyst pointed out that governments have committed to capital spending and are pursuing policies to increase chip-making capacities as well as create local supply chains that can circumvent bottlenecks. South Korea has announced a program worth $450 billion until 2030 that includes corporate investments. It has also beefed-up tax benefits to make its chipmakers more competitive. China has also set up multibillion dollar national funds to invest in local chipmakers. On the other hand, the United States has passed a tech and manufacturing bill that includes $52 billion to fund semi-conductor research, design and manufacturing initiatives. The EU, not to be left behind, has committed significant funds to expand the bloc’s semi-conductor manufacturing.

Uy believes government involvement could help level the playing field and alleviate some of the shortage pressure, especially the price of memory chips, since only a handful of global companies dominate the supply chain.

Pingback: Teachmint announced the first season of their Teacher of the Year awards.