Industry

Aquaconnect partners with Alliance Insurance Brokers to provide insurance to shrimp farmers

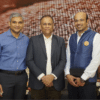

Aquaconnect has partnered with Alliance Insurance Brokers, for an insurance program for 1.5 lakh shrimp farmers across India. After the loan benefit, this is the next step towards the company’s vision to strengthen the financial inclusion of shrimp farmers.

Under this partnership, Aquaconnect will provide risk management services to the insurance partners which include farm data collection, ground validation by Aquaculture officers and AquaCRED dashboard support. The partnership intends to make comprehensive insurance available for shrimp farmers to mitigate weather and disease-related challenges. Farmers will also get an Aquaconnect farm advisory app and options to buy high-quality inputs from the platform.

Rajamanohar, CEO and Founder at Aquaconnect, pointed out that while Indian aquaculture is a multi-billion dollar industry, contributing to 20% of overall agricultural exports, losses due to disease are the biggest impediments to further growth of this sector. “We are happy to partner with Alliance Insurance Brokers to offer the insurance product that would help farmers mitigate the losses in shrimp farming.”

Amit Salunkhe, Head BFSI partnerships, Aquaconnect, said the company’s full-stack technology solutions enable risk profiling of farms with high data integrity and aids transparent and speedy claim management through readily available production level data. “Such interventions can greatly improve the efficiency of BFSI institutions’ engagement with the aquaculture farmers.”

Aatur Thakkar, Co-founder, Alliance Insurance Brokers, said that as an organization driven by sectoral approach Alliance possesses functional expertise Underwriting, Claim and Advisory Services to ensure efficiency in the deliverables. “Aquaculture farming and the Seafood industry being a niche sector, we have developed a strategic partnership with Aquaconnect to help farmers and seafood industry clients to mitigate the risk. Seafood industry is projected to be in excess of Rs 50,000 cr, our focus is to bring tailor-made solution and try to structure a long-term sustainable insurance solution to this sector.”

In the past, low technology adoption and the absence of farm-level production data made it almost impossible for insurance companies to extend their products to farmers. As a result, farmers continued to bear a huge financial risk due to loss of crop. Aquaconnect’s full-stack technology approach endeavours to bring aquaculture farmers into a formal insurance framework through their data-driven approach. Its real-time data brings transparency, hence easing the monitoring and claim settlement process.

Also Read: How this Indore-based startup Gramophone helped 7 Lac farmers increase their yield by 30-40%

Moreover, the combination of data inputs from eyes in the sky, and boots on the ground (primary data from app) supported by machine learning algorithms, bring transparency and predictability to the entire process and helps lower risks associated with aquaculture insurance.

Pingback: MAIT appoints 10 Minutes to 1 for Digital and Policy Communications | The Plunge Daily

Pingback: IndiVillage consolidates support for Israel's agtech firm Taranis