Business

As Amazon plans to acquire Whole Foods Market, here’s a list of their top 5 acquisitions till date

By acquiring Whole Foods at such a high price-tag, compared to any acquisition it has done before, it shows how serious Amazon is about taking over not just the grocery delivery market but also the brick-and-mortar operations.

Announcing their plans to acquire Whole Foods Market for a monumental $13.7 billion all-cash deal, Amazon more than just indicated their interest in taking over the grocery market. According to a report in the TexasMonthly, Whole Foods Market co-founder and CEO, John Mackey, says he was unaware of the development and was in for a shock while on tour promoting his second book. He says, “Usually when these things happen, you get fair warning. They let you know, ‘Hey, we’re going to be buying some stock. I want to meet with management.’ ”

According to Mackey, “The timing was intentional,” he goes on to say, “They hijacked my book tour. It’s not that I think that they were trying to harm the book tour. It’s just like, ‘Okay, the CEO is going to be distracted. He’s not going to be able to give full attention to this.’ ”

While the finer points of how the deal came about can be debated, it is definitely the e-commerce brand’s biggest acquisition so far – the next-closest acquisition was in 2009 when Amazon paid 1.2 billion for Zappos. Here’s taking a quick glance at the five biggest acquisitions of all time by Amazon:

1. Whole Foods Market in 2017 for $13.7 billion

Amazon had made their intention of entering the grocery market quite clear in 2007 when they debuted AmazonFresh grocery delivery service. After expanding across the US, they recently launched AmazonFresh Pickup, which is basically a drive-through grocery store for picking up whatever you order.

2. Zappos in 2009 for 1.2 billion

The former ‘biggest’ acquisition by Amazon was Zappos, an online shoe retailer, for $1.2 billion. The valuation was initially capped at $807 million, however, between the deal and its closing Amazon’s shares had risen hence the increase in value.

3. Twitch in 2014 for $970 million

Until recently, Twitch was Amazon’s second-biggest acquisition of all time. While Google was touted to be in the lead for acquiring the game live streaming company, Bezos’ internet retail delivery company blindsided all competitors and snatched Twitch in an all-cash deal of $970 million.

4. Kiva Systems in 2012 for $775 million

For years Amazon was using Kiva Systems’ automation smarts and robotics in its fulfillment centres. Since they depend on warehousing logistics technology, including automation to assist streamlining operations, the acquiring of Kiva Sytems was a stamped approval of how crucial their technology is to Amazon’s basic functioning.

5. Souq in 2017 for $650 million

While there is no official price announced for the deal, Amazon had, earlier this year, announced finalizing the deal to buy Souq. Souq is the biggest e-commerce site in the middle east or the ‘Amazon of the Middle East’ – if you please. The estimated amount for the deal ranges between $580 million to $750 million, however, the generally accepted value of the proposition is taken to at $650 million.

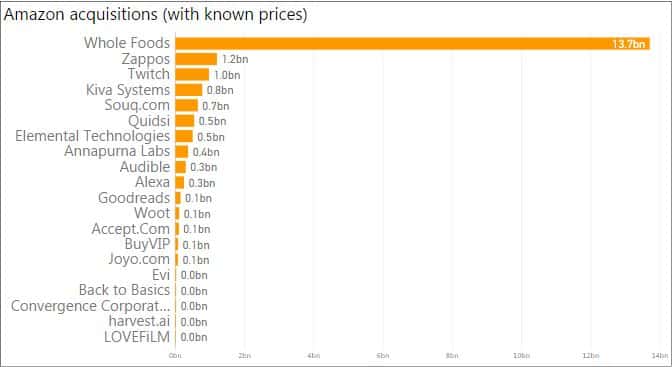

Bezos’s Amazon has made several acquisitions over the years, here’s all of the acquisitions the company has made over the years (with known prices).

Source: techcrunch.com

As per a statement released by the company, John Mackey will remain as CEO of Whole Foods Market. Additionally, Whole Foods Market will continue to operate stores under the Whole Foods Market brand.

Jeff Bezos realizes that to effectively compete in the market of groceries, his company would require an on-the-ground presence that is local and prominent. The fact they are willing to pay $14 billion seems like a justification and once the deal is closed, later in 2017, they will have these precise benefits.

By acquiring Whole Foods at such a high price-tag, compared to any acquisition it has done before, it shows how serious Amazon is about taking over not just the grocery delivery market but also the brick-and-mortar operations.